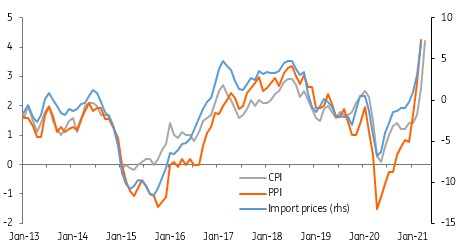

Americans (and by the way, everyone) received a bucket of cold water with the increases in consumer prices in their country in April and May 2021 compared to the same months of 2020: 4.2% and 5% respectively. Figures that differ significantly from the 2% that the Federal Reserve estimates it must be the normal annual rise in prices, despite the sharp increase in the amount of money to which it was forced to put in circulation due to the Pandemic. Temporarily says the Federal Reserve, price increases could be higher than their expectation.

I) INTRODUCTION

The big unknown regarding the United States today is inflation. The effect of Covid-19 on economic activity was simply brutal and did not find the country's economy in its best fiscal and monetary shape. Two indicators were performing well: unemployment at historically very low figures and price inflation slightly below the Federal Reserve's target. Against that, a Treasury in permanent imbalance that has brought public debt to unusual levels and economic growth perhaps acceptable for the peaks in which the United States economy moves, but clearly insufficient to compete with the Chinese economy that still has a lot to grow and that is already making its power felt in world markets. The meager economic growth occurs despite extremely low interest rates that cannot last over time: they seriously affect the ability to save and therefore reduce investment and future growth. At the forefront is a Chinese economy in which savings are more than twice the United States´. Low interest rates also lead to insolvency of the Pension Funds: in less than 15 years they will not be able to meet their obligations to pensioners.

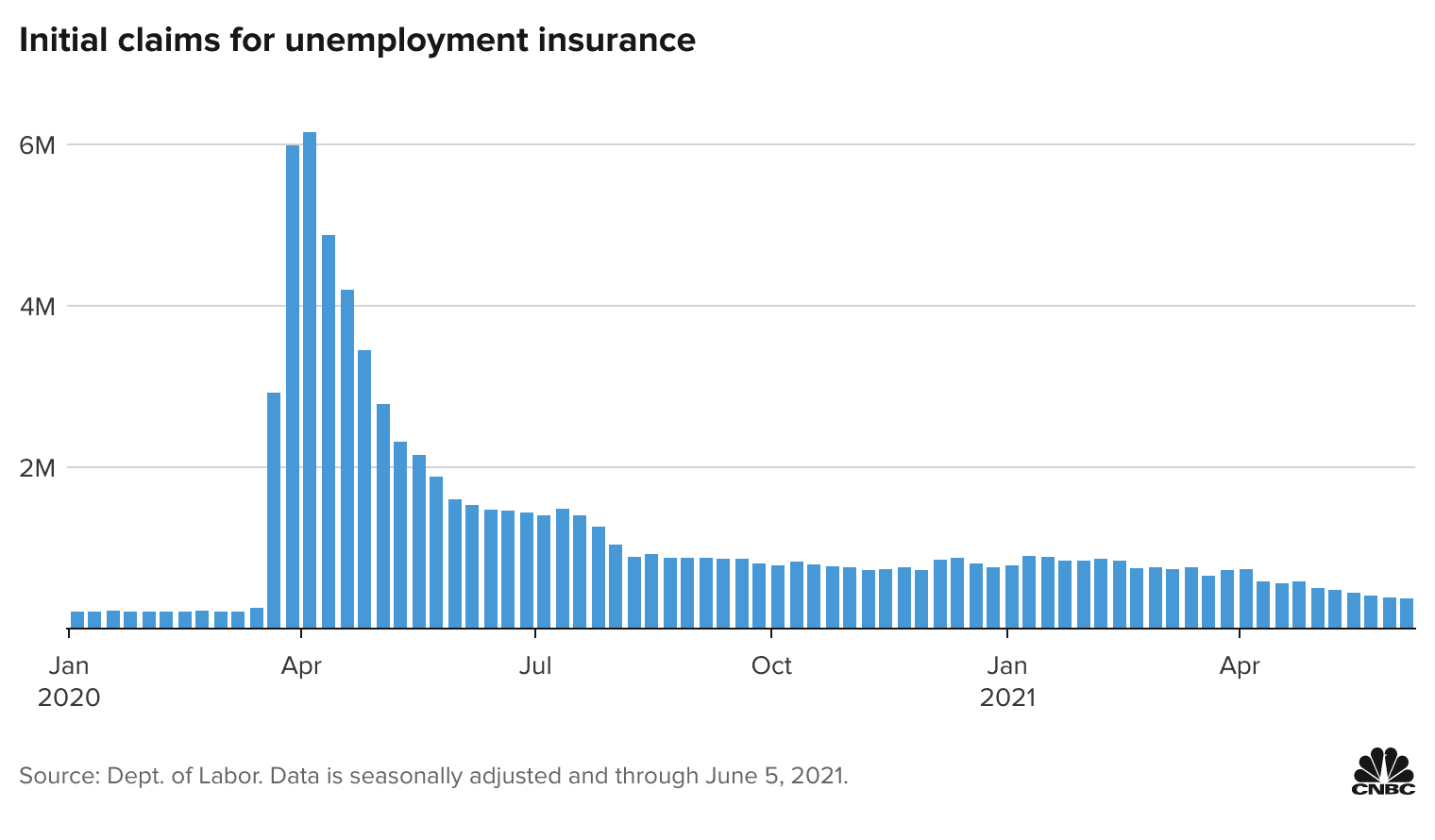

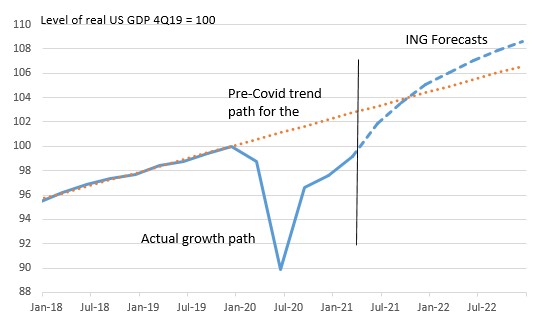

However, in the short term, the measures adopted to mitigate and eliminate the economic damage of Covid-19 have been extremely successful. The atrocious levels of unemployment have practically disappeared and this year the economy will exceed the production it showed before the explosion of the virus (March 2021). This is shown in the following graphs.

The means to achieve this good result has been extraordinary: a great injection of liquidity that far exceeds what had been seen in the entire economic history of mankind. One question remains: will the United States authorities be able to keep price inflation at bay in the face of such an increase in the money supply? Will they be able to revive the handling they did for the SubPrime crisis (2008), a crisis they overcame without generating price inflation?

The attached column reflects the research that I have been able to carry out based on the information available to the general public. For my analysis I tried to be guided by common sense in the face of radically divergent positions of specialists. It is not only that they occupy different theories, it is that they have the public in front of whom they must interpret and try to predict their future behavior.

Jerome Powell, Chairman of the Federal Reserve

What is my conclusion? First, the Federal Reserve showed in the previous crisis that it knows how to withdraw excess liquidity. Can it do it now that the magnitudes are much greater? In theory, yes. Will there be problems during the period this process is completed? Possibly, because otherwise the Federal Reserve would have a superhuman sensitivity to economic circumstances. In any case, it can always use the sale of Treasury Bonds and other debt securities with the disadvantage, yes, that these operations lead to increases in interest rates and as a consequence, a climate favorable to a recession. Second, the great battle is that of expectations. Will the public in the United States and abroad believe that price inflation is likely? If the public think so then it reaction will produce the much-dreaded inflation. That is why the Federal Reserve, and its chairman are so eager to assure the public that price growth rates will not exceed 2%.

Monthly price increase compared to the same month of the previous year

The following table shows price increases in the last 30 years. It is observed that the growth of prices in recent months, although high, are not unique in the last 30 years. The same happened before in the Sub Prime crisis in 2008 and also in the early 90s.

Three coincident indicators regarding current price inflation

II) In the United States today the "Trillion Dollar Questions" are common.

Will prices continue to escalate? Will the United States rush into price inflation in the style that is so common in South American countries? Can it sustain a large increase in the amount of dollars in circulation without causing price chaos? Will interest rates rise as a result of some plan to control inflation if it becomes a reality? What economic effects does the high Public Debt generate? These are no idle questions for a country that is struggling in a deep political crisis.

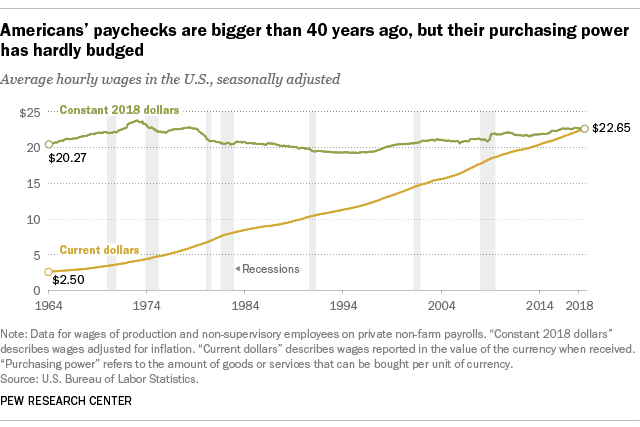

It is of all judgment that citizens in America today complain about the end of the "American Dream". What was it made of? Average hourly pay appears to have increased nine times in 54 years (1964-2018). The truth: It only increased by 10%! The rest (almost everything): Inflation! And is anyone surprised that the country is deeply divided? The social failure behind the last fifty years must have puzzled society in the United States. Where did the immense progress of this period go? Wasn't it the age of computer science, gigantic scientific and technological progress, and digital transformation? Socially, the United States "steps on eggs" and it is natural for them to break down. Obviously, it is a country that today cannot afford any mistakes in the decisions it makes. So far, despite poor initial handling of the virus, economic therapies have worked very well. The last chapter remains to be seen, a very difficult one: how the United States dodges potential price inflation, a disease that, if it appears, will leave many dead along the way.

Average hourly wage increases in current dollars (orange line) and real change adjusted for price increases (green line)

Everything is settled with dollars

Like a "knight errant" Biden lunges; his windmills are the many problems that his country drags and of course those that Covid 19 caused in the United States economy. His weapon: the gigantic sack of money made available to him by the Federal Reserve. No surprise then that the Federal Debt is growing out of control. At this point, in the face of the shyness of traditional investors (for a reason), the great buyer of the United States Treasury Bonds is the Federal Reserve.

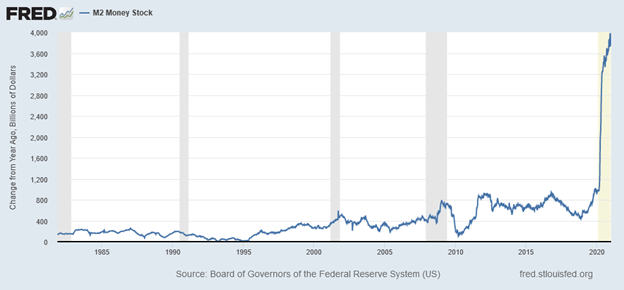

USA: Increase in the amount of money in billions of dollars

The Federal Reserve and Federal Debt

The graph below shows that the total of Federal Government securities held by the Federal Reserve at the end of last April, was approaching 5 trillion dollars, about 4 trillion dollars more than before the Sub Prime crisis of 2007. How could the Federal Reserve buy these securities? Very simple, increasing the amount of money: it financed the increase in Federal Debt by approximately 2 trillion in the thirteen years prior to Covid-19, and 2.1 Trillion dollars after March 20, 2020.

Monetary inflation (the increase in the quantity of money) is a fact in the United States. To the "Easy Money" that seeks to bring interest rates close to zero to stimulate economic activity, and which began with the Sub Prime crisis, it was added the need to finance through the Federal Reserve (a kind of Central Bank of the United States ) the increase in the Federal Debt not only due to the already usual deficits of the Federal Government's budgets, but also due to the extraordinary expenses it has incurred to face the Covid 19 emergency.

The public has the floor

The statements of Jerome Powell, the Chairman of the Federal Reserve, suggest that his body is the only one that intervenes in the determination of the price level. He postulates, Urbi et orbi, that prices will grow at 2% per year even though there may be months above that figure. Can Powell just guess the behavior of the public, a major player in determining price levels? Because it is the public (individuals and companies, nationals and foreigners) who decide how much money, how many dollars they want the economy to have; it does so by adjusting real money to its desires by driving price variations ("real money" denotes money in relation to the price level). Prices are the escape valve in case the public wants to have more or less real money. Thus, prices can change because the authority raises or lowers the amount of nominal money but also because the public decides to change its demand for money or liquidity (money in a broader sense).

When it comes to inflation, the public is a raging monster that hopefully may sleep for a long hibernation. This is how the Central Banks want it; they are aiming to make the public demand for money or liquidity as even as possible and thus make the effects of variations in the amount of money they produce more predictable. If there is a lot of noise –and today there is– the monster could wake up and destroy what they put in front of it, it could change expectations and consequently the public's idea of how much money it needs. Isn't the massive increase in America's means of payment noisy enough? Now the indexes of increases in the prices of April and May are added to the rattle. The Federal Government in turn does not help at all: it does everything possible to awaken the monster; it solves its problems with more spending, more deficits, and more debt financed with money created by the Federal Reserve. And moreover, the public's dream could be ended by the increase in value that the shares have experienced as seen in the following graph that shows almost a 16% increase in their value in the first half of this year

From February 10, 2020, immediately before the worst of Covid-19 was sensed, until July 2, 2021, the value index of the S&P 500 shares has risen 28.5%. What can explain this spectacular increase at a time when business uncertainty is at its highest? Isn't it a reflection of the excess liquidity that stocks are looking for to cover? At least so the prominent professor Ariel Roubini believes. If it weren't directly due to excess liquidity, it would be indirectly due to lower interest rates that have been the other side of the medal for financing the fiscal deficit through the Federal Reserve.

The prices of "Commodities" also show "strange" movements according to the gray line of the following graph. What explains them? If current prices are compared with those of January 2020, a growth of close to 20%

Roubini also believes that in the world today there are "productive shocks" that prevent meeting all the demand for the affected products. This is the case of microchips among others. These situations translate into price rises that could contribute, at a time of confusion, to changing public expectations.

Given the enormous magnitude of the amount of money that the Federal Reserve should neutralize (withdraw from the hands of the public), it is necessary to consider the time it takes this process as a factor that could unbalance the fragile equilibrium of prices. Leaving new money in the hands of banks and the public for longer than necessary could create demands that also put pressure on prices. The speed of the withdrawal of the money is critical and of course not easy to determine.

It is possible that the explosive increase in the quantity of money has caused a lesser change in prices to date (as has been seen) because the uncertainty that the Pandemic has caused leads to think that the public increased their need for money or liquidity as a form of protection. That this trend will continue in the future is very unlikely because everything indicates that in months or so, the problem of Covid 19 will tend to decrease and thus the uncertainty that the virus introduced into the economy. This will bring about a lower demand for money or liquidity than the current one. It will then be necessary to withdraw a lot of money from the public and the banks. In the United States, the last word has not yet been said regarding the surprising increase that the money supply has experienced and that will still grow all this year at the rate of US $ 120,000 million per month.

In addition to the above, and unlike the Sub Prime crisis, it is added that the new money has largely reached the Federal Government, which, like all governments in the world, is a money-spending machine. In the previous crisis of 2008-2009 which did not generate price inflation, although money inflation did, it reached the banks that had to lend it so that the public could have it, a more complex and more controlled process than the current one. It could be said that in the current case the injection of liquidity has gone directly "to the vein". It is not surprising then that production is rapidly recovering and that there is upward pressure on prices.

The expectations

It would not be surprising today that the public believe that their money balances will depreciate and their demand for money will, as a consequence, decline. Expectations are today the great risk of the Federal Reserve. It could fare well from the gigantic challenge that it took on its back –and it better be so for the sake of half humanity at least– if the public does not change its expectations and maintain its demand for money. It already happened in the previous crisis. It needs to neutralize the massive increase in money (for now it is doing so but partially) by attracting to it what it has ended up into the banks.

The Federal Reserve's weapon

Will Jerome Power get the United States out of the mess it is in after the Federal Reserve helps the Federal Government and the economy of his country? The task is not easy: The Federal Reserve will have to neutralize trillions of dollars and, incidentally, take care that the public (national and foreign) trust in the dollar is maintained.

Amount of money in the United States (M2)

The amount of money has grown substantially since the beginning of the Pandemic.

March 9, 2020 US $ 15.6 trillion

June 29, 2020 US $ 18.2 trillion

May 31, 2021 US $ 20.3 trillion

The above figures show a growth of 30%. What is the Federal Reserve's formula to neutralize this increase?

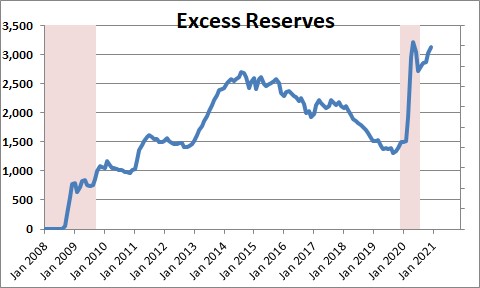

The use of the "Additional Reserves" to the legal ones of the Banks in the Federal Reserve. It is the mechanism that neutralized the increase in the amount of money in the previous crisis of 2007-2008, the Sub Prime crisis. A clever mechanism that allowed price growth to remain around 2% for several years, a very different percentage from the increase in the amount of money that the Federal Reserve generated by buying astronomical amounts of mortgage loans from banks. To recover that money and not affect prices, the Federal Reserve paid interest for "additional deposits" that went beyond the banks' legal reserves. For the Banks it was more attractive to deposit part of their funds in the Federal Reserve than to increase credit to the public. In this way, the Federal Reserve neutralized the money that could have pushed prices up.

The following graph shows that Additional Reserves grew by US $ 1.5 trillion between March and December 2020.

The Federal Reserve began to strongly operate the system of "additional reserves" as soon as it began to increase the amount of money to mitigate the damages of Covid-19, in March-April 2020. As of March 31, 2020 the additional reserves were US $ 2.1 trillion. In May 2020 they had reached US $ 3.2 trillion and a year later in May 2021, to US $ 3.9 trillion, an increase of US $ 1.8 trillion. Meanwhile, money increased by US $ 4.7 trillion, so the next task for the Federal Reserve is to neutralize US $ 2.9 trillion, 14.4% of the amount of money that circulated in May 2021.

Additional Bank Reserves in the US Federal Reserve

The Dollar as Reserve Currency

Foreigners who invested in dollars, confident that they had chosen a stable currency, would not be happy with price inflation in the United States. The devaluation of the purchasing power of assets held in dollars can be substantial if price inflation in the United States rises above 2%, which is the goal set by the Federal Reserve. With what consequences?

The first would be a loss of value of the dollar in international markets. A currency that loses its value due to price inflation does not fit as a reserve currency. There would be a tendency to liquidate holdings in dollars.

A nightmare for America! An international run against the dollar would make it pay the cost of having evolved from being a reasonably serious country in the early 1970s to being an irresponsible country fifty years later. Having freed itself from the Gold Standard, which required a serious administration of its currency, has cost the United States dearly. At the end of the day, it would not be free to have made fun of all those who trusted that the Gold Standard was "forever".

The second, the search for alternative currencies to replace the dollar and suitable currencies for international trade. If this happened, the loss for the United States would be serious. It would cease to receive as annual income the increase in money required by the growth of the world's international trade and the increases in reserves of other countries, amounts that add up to several hundred billions of dollars each year and which have been an income for the United States. at zero cost.

In the long term there is a tendency for Central Banks to diversify their reserve currencies. The dollar has lost its share and today it represents 59% of the reserves of the countries of the world.

The only good that appears in the midst of possible misfortunes is that the United States dollar, if it lost its international functions, could be devalued, which would restore the balance of international accounts and make the United States economy competitive again instead of resorting to "the patch solutions" that politicians use to warm the minds of citizens. There would be less Chinese mythology and more focus on increasing and improving US productions

An exciting show!

At least in the middle of the storm, there will be entertainment. Will inflation get out of control under Jerome Powell policies? Can it contain the stampede of those who want to abandon the dollar? Will interest go up? How much? Will the price of assets fall? Will the difficulties that the United States is experiencing put an end to the drunkenness of politicians in Washington? Will they put their feet on the ground? Will they understand the damage they have done to their country? Will the stupid challenges to China end, a country that quietly and quietly became a great world power? Will the United States accept that it is no longer the Exceptional Nation? Will he get off the podium without violence?

Recommended Articles

Thomas Hogan American Institute for Economic Research

- Did the Fed Just Raise Interest Rates?

https://www.aier.org/article/

did-the-fed-just-raise- interest-rates/

- Is Inflation Below the Fed’s Target? Yes and No https://www.aier.org/article/

is-inflation-below-the-feds- target-yes-and-no/

- Do These Money Supply Charts Portend Hyperinflation?

https://www.aier.org/article/

do-these-money-supply-charts- portend-hyperinflation/

James Caton American Institute for Economic Research

-) Why Do Inflation Expectations Matter? Https: //www.aier.org/article/why-do-

inflation-expectations-matter/

Steve Hanke Johns Hopkins University

-) US inflation surge is harbinger of what’s to come https: //www.omfif.org/2021/05/us-

inflation-surge-is-harbinger- of-whats-to-come/

Alasdair Mccleod FinanceAndEconomics.org,

Too much Liquidity

https://www.lewrockwell.com/

2021/06/alasdair-macleod/too- much-liquidity/

Reuters

-) Analysis: Economists eye surging money supply as inflation fears mount

https://www.reuters.com/

article/us-usa-bonds- inflation-analysis- idCAKCN2DT1VX

Brookings March 30, 2021

What's the Fed doing in response to the COVID-19 crisis? What more could it do?

https://www.brookings.edu/

research/fed-response-to- covid19/

John mauldin

May 28, 2021 Deflation Talk

https://www.mauldineconomics.

com/frontlinethoughts/ deflation-talk

September 25, 2020 Great Reset Update: $ 50 Trillion Debt Coming

https://www.mauldineconomics.

com/frontlinethoughts/great- reset-update-50-trillion-debt- coming

ING THINK

US: Inflation - to the moonU: Inflation - to thus

https://think.ing.com/

articles/us-inflation-to-the- moon/

Issues and Insights Editorial Board

Inflation’s Here, Getting Worse, And Could Last Longer Than COVID Pandemic

CNBC

Consumer prices jump 5% in May, fastest pace since the summer of 2008

https://www.cnbc.com/2021/06/

10/cpi-may-2021.html

Forbes

U.S. National Debt Expected To Approach $ 89 Trillion By 2029

Wharton

U.S. Covid-19. Stimulus and Relief

https://www.investopedia.com/

government-stimulus-efforts- to-fight-the-covid-19-crisis- 4799723

No hay comentarios:

Publicar un comentario